ASC Title & Tags

Notary & Title Services

Over 30 years of working for you with PennDot

1012 Pottstown Pike, Chester Springs, PA 19425 - GOOGLE MAP

610-458-0161 610-458-8395 Fax: 610-458-8735

e-mail: asctitle@yahoo.com

Gifting a Vehicle and Penndot

Written by ASC Title & Tags May 17, 2018

Which one of statements is true when selling your car?

- You can only give a gift to your children

- Gifts are not permitted

- You must sell your car for $1.00

- None of the above

The answer is d. That's right. You can personally give a car to anyone at any time.

Example #1

If your daughter just graduated and you want her off your insurance policy, feel free to give her the car. Why not, she is heading off on her own, striking out into the big world to make a name for herself. She deserves it, and that's what you should tell her. Besides, you'll probably save the equivalent of entire value of that car in just 3 years with how much your insurance cost will drop, but she doesn't need to know that.

Example #2

If you know someone who is in desperate need of a car and you have the ability to be charitable, please do so. Everyone could use a little help now and then. Besides, dealing with selling the car for it's value may just not be worth dealing with every yahoo that contacts you from Craigslist or Facebook Marketplace. Here's a perfect example.

In the early 2000's, my wife had a very nice 1987 Chrysler LeBaron. It was the first year of the swoopy body style, 4 cylinder, great gas mileage. The interior was nice and so was the body and paint. Really nice. She hated the car. So after owning it for 2 years, I got her something else and attempted to sell the car. I wanted it gone so I advertised it for only $800. I received 2 types of calls. “Why is it so expensive, I can buy them all day long for $500”. Sure, but those were rough condition, needing paint and a new top. The other was “Why is it so cheap? What is wrong with it”. The car needed nothing. Get in it and drive it across the country. After 3 weeks, we were so disgusted with the tire kickers that had nothing better to do than waste time, we gave it to a friend who could really use a second car. It was very satisfying knowing that his family would enjoy it for the summer. Could I use the $800? Absolutely, but not as much as keeping my sanity. This could certainly be the option for you.

Example #3

You have had a camper in your back yard for 3 years. You bought it to take the family out camping. It seemed like a good idea at the time. Get the family away, to the great outdoors, fresh air, sunshine. You had visions of fishing with the kids, your wife cooking what you caught, over an open flame. Campfire songs at night. The spouse wanted cable TV when you go away. The kids couldn't get a cell tower so they couldn't text. There went the visions of family togetherness. Now you mow around this damn thing.

Your cousin was in from out of town and saw the camper in the back yard and mentioned he always wanted to do the same thing you envisioned. Quick! While you have a live one, get over to our office and get it transferred. And by all means, make him take it with him immediately, because when his significant other finds out what he did, he will never come back for it and it will still be in your yard and you won't even own it to get rid of it!

Why Not Sell Your Car For One Dollar?

You “heard” gifts are not allowed by law. In other States, sure, but not Pennsylvania. The assumption is that if a vehicle is sold for $1, that circumvents the system of not being able to give the vehicle away. Please, don't do that. That is a red flag at Penndot. Minimum value of any car over 15 years old is $500 in Penndot's view. You may become the subject of an audit letter for the $1.00, which you may receive a tax bill calculated on what the NADA retail value is. Then you will have to defend your position. Why would you expose yourself to that type of scrutiny for a legitimate act of kindness?

How is a Gift Exemption performed in Pennsylvania?

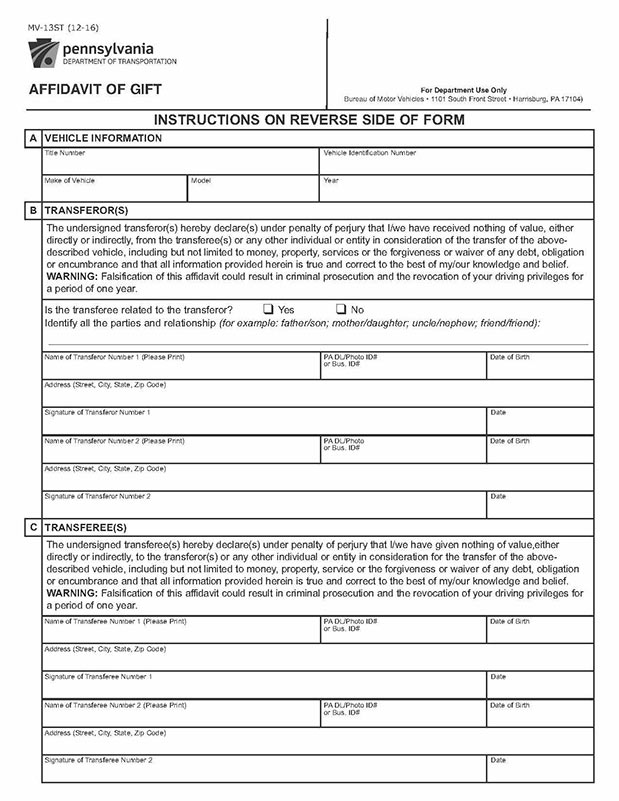

When you come into the title & tag office, let them know that you are giving the vehicle to the individual(s) with you. The clerk with have you fill out an MV-13ST. This is the gift exemption form. It is only for gifts. There can be no bartering or trades in-kind. The transition must be a straight up, no strings attached, gift. There is a clear warning on the Affidavit and you can be fined or lose your driving privileges if you falsify information.

That's it. The MV-13 gets attached to the other transfer documents and the transferee (because there is no purchaser) gets the vehicle with no sales tax liability. So when your neighbor, or cousin that's into cars, or the guy from your local garage tell you that you cannot gift a car, they don't really know the real answer. You should pick up the phone and call us first!